Gold and silver have captivated human interest for centuries, symbolizing wealth, security, and power. During the Roman Empire, for example, gold and silver coins served as primary instruments of trade and wealth storage, contributing to economic stability across vast regions. In the modern world, these precious metals provide a unique hedge against economic uncertainty, acting as a stable foundation in an investment portfolio. Whether you are new to investing or a seasoned investor seeking stability, gold and silver offer significant potential to protect and grow your wealth. This guide explores strategies for investing in gold and silver and highlights potential profitable opportunities.

Why Invest in Gold & Silver?

A Hedge Against Inflation and Economic Uncertainty

Gold and silver are well-known for their ability to act as hedges against inflation. When paper currencies depreciate, precious metals tend to increase in value. As global markets fluctuate and currencies face devaluation, gold and silver have historically retained their value—trusted for their stability over millennia.

Diversification Benefits

As of November 2024, central banks have continued to increase their gold reserves, reflecting a sustained belief in gold's reliability as an asset amid economic uncertainties. This trend highlights the strategic importance of gold in national reserves, especially as the U.S. national debt approaches $36 trillion, underscoring concerns over fiat currency stability. [https://usdebtclock.org]

Adding gold and silver to your portfolio can enhance diversification. For instance, during the 2008 financial crisis, gold prices rose significantly while the stock market plummeted, demonstrating how precious metals can stabilize portfolios when other assets are underperforming. Unlike stocks or real estate, these metals are not directly correlated with traditional markets, meaning that when other assets decline, gold and silver can maintain their value or even appreciate, balancing your overall investment strategy.

Tangible Wealth

Gold and silver represent something intangible assets cannot—they are physical, tangible forms of wealth. Owning these precious metals provides a sense of security, as they are not entirely tied up in digital assets or reliant on financial institutions.

Getting Started: Practical Advice for New Investors

Tax Considerations

Investing in physical or digital gold and silver can have tax implications, such as capital gains tax. When selling precious metals, any profit realized may be subject to taxation. It is crucial to consult with a tax professional to understand your specific tax obligations, as they can vary considerably by country.

Historical Performance

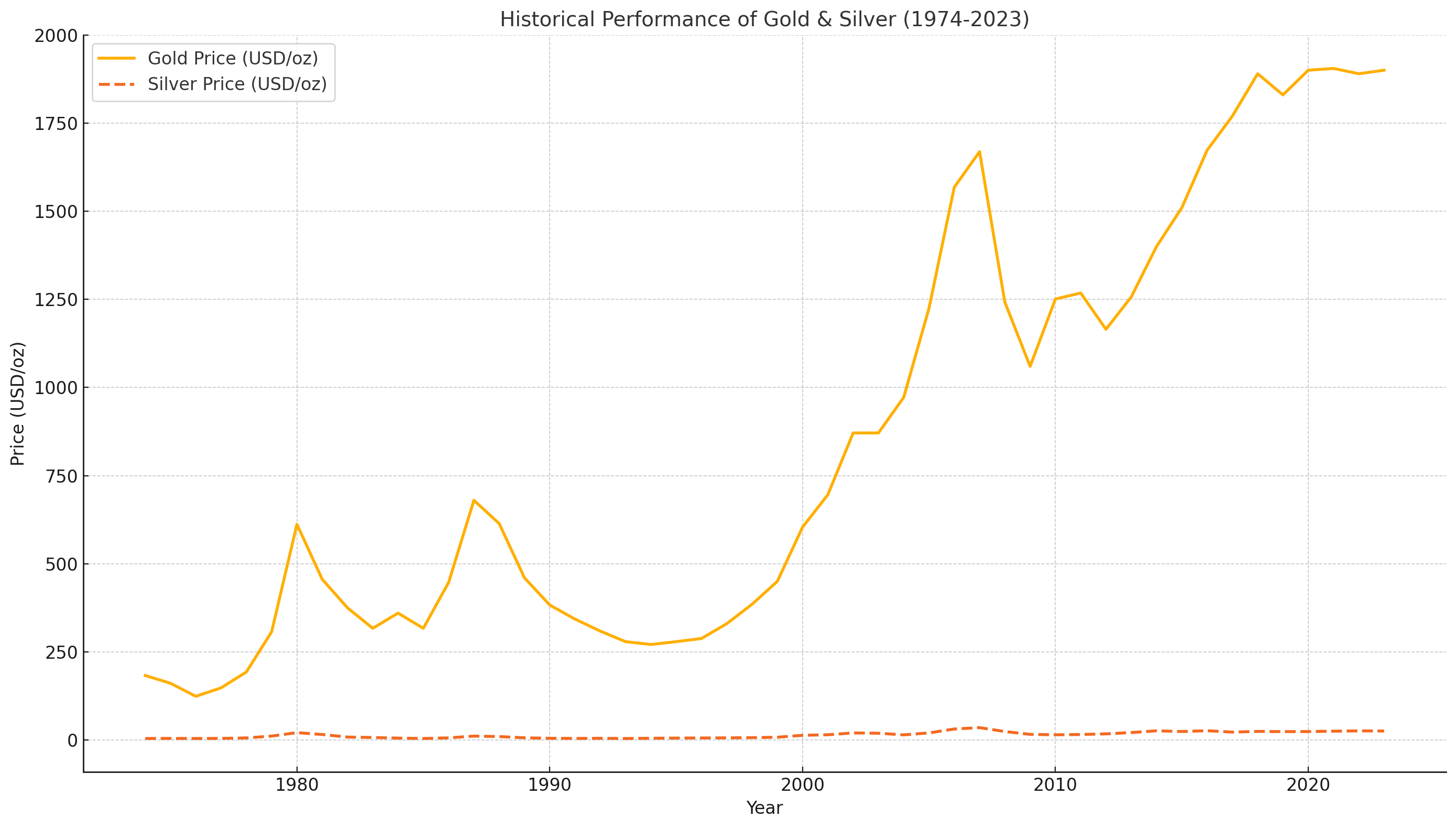

Over the past 50 years, gold and silver have demonstrated their ability to retain value, especially during economic crises. During the 1970s oil crisis and the 2008 financial meltdown, for instance, gold prices surged as investors sought safe-haven assets. Below is a chart summarizing the historical performance of gold and silver compared to major economic events:

Historical Performance of Gold & Silver

Pros and Cons Table

| Ownership Type | Pros | Cons |

|---|---|---|

| Physical Metals | Tangible asset, full control, no counterparty risk | Requires secure storage, less liquid |

| Digital Metals | Easy to trade, no storage issues | Management fees, relies on third-party trust |

Buying Physical vs. Digital Gold and Silver

You can invest in gold and silver by purchasing physical bullion, coins, or bars, or by opting for digital ownership through ETFs (Exchange-Traded Funds) and other investment platforms. Physical gold and silver involve additional costs for secure storage and insurance, whereas digital ownership typically involves management fees but provides greater liquidity and ease of trade.

- Physical Gold & Silver: Bars and coins are ideal for investors who want direct access to their assets. Popular options include American Eagle gold coins and silver bars from trusted mints.

- Digital Ownership: ETFs or gold-backed cryptocurrencies provide a more convenient way to gain exposure to these metals without the hassle of storage and insurance.

Consider your investment goals: Physical metals provide security and stability, while digital investments offer liquidity and convenience.

Trusted Tools and Platforms

- BullionVault: Allows you to buy, store, and sell gold and silver online.

- Goldmoney: Offers secure metal storage and allows you to spend metals via a prepaid card.

- Crypto-backed Options: Platforms like Paxos provide access to gold-backed tokens, enabling easy trades between crypto and gold.

Actionable Steps to Begin Your Gold & Silver Journey

- Define Your Budget: If you're new to investing, start small. Allocating even 5% of your portfolio to gold and silver can add stability.

- Choose the Right Form: Decide whether physical or digital ownership best suits your needs. Physical metals require secure storage, while digital investments offer greater flexibility.

- Use a Reputable Dealer: Whether purchasing online or in person, always use a reputable dealer to ensure authenticity.

- Plan for Storage: Store your physical gold and silver securely, either with a trusted vault service or at home in a high-quality safe.

Profitable Opportunities in Gold & Silver Investments

Comparative Analysis

Gold and silver possess unique strengths compared to other asset classes such as stocks and real estate. During both bull and bear markets, gold and silver have often acted as safe havens, providing stability while stocks and real estate face high volatility. For example, during economic downturns, gold tends to increase in value while real estate may stagnate or decline.

Use Cases Beyond Investment

Gold and silver are not only valuable for investment purposes but also play essential roles in various industries. Gold is widely used in electronics due to its superior conductivity, while silver is integral to solar panels and medical devices. Both metals are also fundamental to the jewelry industry. These industrial applications contribute to their overall demand and market value, making them more than just hedges against inflation.

Future Outlook

Experts predict that demand for gold and silver will continue to rise amid growing economic uncertainties, increasing industrial needs, and central bank policies. Some analysts expect gold prices to climb further as inflation concerns intensify, while silver, with its dual role as both an industrial and precious metal, could see even higher relative gains. Including expert opinions on future trends provides valuable insights into potential opportunities and risks associated with investing in these metals.

Earning Passive Income

Some platforms allow investors to earn interest on gold and silver holdings, such as the precious metals savings accounts offered by Goldmoney. While specific interest rates vary based on market conditions and platform policies, these accounts typically offer modest returns compared to traditional savings accounts. For example, as of 2024, some precious metals savings accounts have provided interest rates ranging from 0.5% to 2% annually. Note that these rates can change, influenced by factors like storage fees and market demand. Therefore, it's advisable to consult the latest information from the platform to understand current rates and associated costs. Additionally, platforms like Celsius Network allow you to collateralize your gold for loans, enabling you to pursue other investment opportunities without having to sell your metals.

Leveraging Market Trends

The market for precious metals is dynamic, often influenced by geopolitical events and currency devaluation. Staying informed with market news and using tools like Kitco's Spot Price Charts can help you make informed decisions to buy low and sell high, maximizing your profits.

Security and Best Practices

Avoid Common Pitfalls

- Counterfeit Risk: Always verify the authenticity of physical metals through certified dealers or assay services.

- Storage Risks: Physical metals require secure storage. Consider third-party vaulting services to protect your assets from theft or damage.

Best Practices for Secure Investing

- Diversify Within Metals: Invest in both gold and silver to further hedge risks. Silver tends to be more volatile but can offer higher returns.

- Keep Transaction Records: Maintain detailed records of purchases, including dealer information and serial numbers of bars.

Exclusive Forums and Community Discussions

Join our exclusive forums to connect with like-minded investors. Share your experiences, strategies, and market insights with the RealEstateCryptoHub community. Dive into discussions on precious metals and discover how gold and silver can complement your broader investment portfolio. Our community is here to support your journey, providing valuable answers to your questions and helping you make informed decisions.

Freemium and Premium Memberships

Take the next step in your investment journey. Start by subscribing to our newsletter for the latest insights, strategies, and exclusive content from RealEstateCryptoHub. Connect with fellow investors in our community discussions to exchange knowledge and grow together.

For even more value, consider joining our free community to access the Real Estate & Crypto Wealth Guide, which is filled with practical insights and tips. Ready for more advanced strategies and exclusive investor forums? Upgrade to our premium membership to gain access to tailored content that will help accelerate your success.

Stay Ahead in Your Investment Journey

Stay informed with the latest market insights and exclusive strategies by signing up for our newsletter today. Your support allows us to continue delivering high-quality content—consider making a small contribution to keep RealEstateCryptoHub thriving and growing.

Conclusion: Securing Your Financial Future with Gold & Silver

Gold and silver offer unique opportunities for investors of all levels, providing a means to safeguard wealth and diversify portfolios. Whether you're aiming to hedge against inflation, balance your investments, or add tangible security, precious metals have much to offer.

Explore More

Discover our related articles on diversifying investments and understanding crypto-backed precious metals to deepen your knowledge and enhance your investment strategy.

Stay Connected

Sign up for the RealEstateCryptoHub newsletter for the latest insights and trends in gold, silver, and beyond. Join our community discussions to learn from others and grow your knowledge alongside fellow investors.

Share Your Thoughts

We'd love to hear from you! What are your thoughts on investing in gold and silver? Do you have any strategies that have worked well for you? Leave a comment below to keep the conversation going.

Ready to take your investments to the next level? Join our Wealth Guide for exclusive insights and unlock premium benefits to accelerate your financial journey.

Conclusion: Securing Your Financial Future with Gold & Silver

Gold and silver present unique opportunities for investors of all levels to safeguard their wealth and diversify their portfolios. Whether you are seeking a hedge against inflation, a way to balance your investments, or tangible security, gold and silver offer immense value.

Explore More: Dive into our related articles on diversifying investments and understanding crypto-backed precious metals to gain deeper insights and maximize your investment strategy.

Stay Connected: Sign up for the RealEstateCryptoHub newsletter to stay informed about the latest insights and trends in gold, silver, and beyond. Join our community discussions for deeper insights and grow alongside fellow investors.

Share Your Thoughts

What are your thoughts on investing in gold and silver? Are there specific strategies you have found effective? Leave a comment below, and let’s keep the conversation going.

Ready to take your investment game to the next level? Join our Wealth Guide for exclusive insights and unlock premium benefits to accelerate your financial journey.